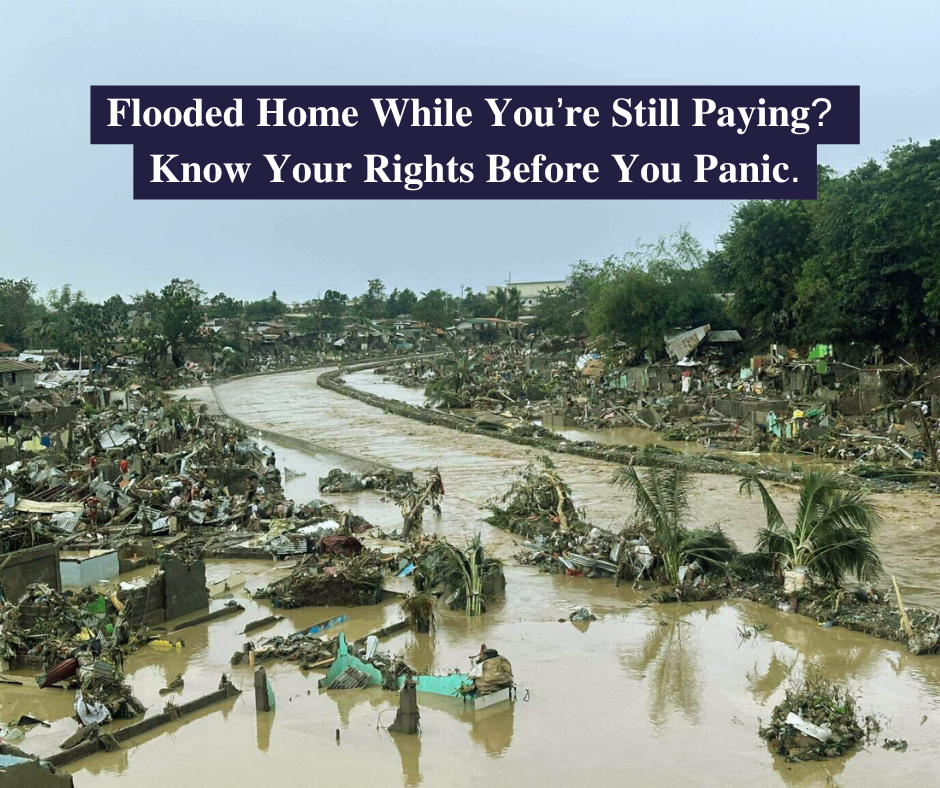

When a typhoon wipes out or floods a property you’re still paying for, the rules change depending on where you are in the process: pre-turnover (equity stage) or post-turnover (already amortizing). Under the Civil Code (fortuitous events), PD 957 (developer duties), the Maceda Law (installment buyers’ rights), and the Insurance Code (claims for typhoon/flood), you may have clear remedies—from demanding restoration or delivery, to filing an insurance claim, or even pursuing a refund/cancellation in specific cases. Read on for the quick checklist so you don’t miss deadlines or lose money.

𝟏) 𝐖𝐡𝐚𝐭 𝐦𝐚𝐭𝐭𝐞𝐫𝐬 𝐟𝐢𝐫𝐬𝐭: 𝐖𝐡𝐨 𝐚𝐥𝐫𝐞𝐚𝐝𝐲 𝐛𝐞𝐚𝐫𝐬 𝐭𝐡𝐞 𝐫𝐢𝐬𝐤 𝐨𝐟 𝐥𝐨𝐬𝐬?

➡𝐔𝐧𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐢𝐯𝐢𝐥 𝐂𝐨𝐝𝐞, risk generally follows ownership (“res perit domino”). Title usually passes upon delivery (actual or constructive), or as the contract stipulates. In many “contract-to-sell” arrangements, developers reserve ownership until full payment, but may already give possession; the contract’s wording is crucial.

➡𝐁𝐞𝐟𝐨𝐫𝐞 𝐝𝐞𝐥𝐢𝐯𝐞𝐫𝐲/𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫 (𝐭𝐲𝐩𝐢𝐜𝐚𝐥𝐥𝐲 𝐭𝐡𝐞 “𝐞𝐪𝐮𝐢𝐭𝐲” 𝐬𝐭𝐚𝐠𝐞): Developer still bears the primary duty to deliver per plan; typhoon/flood is a fortuitous event under Art. 1174, so parties aren’t liable for each other’s damages due to the disaster—but the duty to complete/restore and deliver per PD 957 remains on the developer within regulatory timelines. You may pursue remedies if they fail to deliver.

➡𝐀𝐟𝐭𝐞𝐫 𝐝𝐞𝐥𝐢𝐯𝐞𝐫𝐲/𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫 (𝐲𝐨𝐮’𝐫𝐞 𝐚𝐥𝐫𝐞𝐚𝐝𝐲 𝐚𝐦𝐨𝐫𝐭𝐢𝐳𝐢𝐧𝐠 𝐨𝐫 𝐦𝐨𝐯𝐞𝐝 𝐢𝐧): You (the owner) generally bear the loss from a fortuitous event; the bank loan does not stop just because the house was damaged—insurance is your financial backstop.

𝟐) 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐥𝐚𝐰𝐬 𝐲𝐨𝐮 𝐜𝐚𝐧 𝐜𝐢𝐭𝐞 𝐨𝐫 𝐫𝐞𝐥𝐲 𝐨𝐧

➡𝐀𝐫𝐭. 𝟏𝟏𝟕𝟒, 𝐂𝐢𝐯𝐢𝐥 𝐂𝐨𝐝𝐞 – Fortuitous events. Typhoons/floods are acts of God; parties aren’t liable for such events unless the law or contract says otherwise.

Legal Resource PH

➡𝐀𝐫𝐭𝐬. 𝟏𝟒𝟕𝟕 & 𝟏𝟒𝟕𝟖, 𝐂𝐢𝐯𝐢𝐥 𝐂𝐨𝐝𝐞 – Ownership & reservation. Ownership transfers on delivery; parties may stipulate that title passes only after full payment (typical in contract-to-sell). This allocation influences who bears risk.

ChanRobles

➡𝐏𝐃 𝟗𝟓𝟕 (𝐒𝐮𝐛𝐝𝐢𝐯𝐢𝐬𝐢𝐨𝐧 & 𝐂𝐨𝐧𝐝𝐨𝐦𝐢𝐧𝐢𝐮𝐦 𝐁𝐮𝐲𝐞𝐫𝐬’ 𝐏𝐫𝐨𝐭𝐞𝐜𝐭𝐢𝐯𝐞 𝐃𝐞𝐜𝐫𝐞𝐞). Developer must complete and deliver according to approved plans and advertised warranties (Sec. 20), and buyers have remedies (regulatory sanctions; civil actions) if the developer fails to deliver/complete on time—even after calamities.

➡𝐌𝐚𝐜𝐞𝐝𝐚 𝐋𝐚𝐰 – 𝐑.𝐀. 𝟔𝟓𝟓𝟐. If you’re buying on installment and decide to cancel (e.g., developer non-delivery or you can’t continue), this law gives refund/grace rights depending on how long you’ve been paying. It’s often used together with PD 957 when there’s non-delivery.

➡𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐂𝐨𝐝𝐞 (𝐑.𝐀. 𝟏𝟎𝟔𝟎𝟕). You must have an insurable interest at the time the policy takes effect and at the time of loss to claim (property policies + riders for typhoon/flood). Banks typically require fire insurance; typhoon/flood are add-ons—check your policy.

𝟑) 𝐖𝐡𝐚𝐭 𝐮𝐬𝐮𝐚𝐥𝐥𝐲 𝐡𝐚𝐩𝐩𝐞𝐧𝐬, 𝐬𝐜𝐞𝐧𝐚𝐫𝐢𝐨 𝐛𝐲 𝐬𝐜𝐞𝐧𝐚𝐫𝐢𝐨

𝐀) 𝐏𝐫𝐞-𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫 (𝐬𝐭𝐢𝐥𝐥 𝐩𝐚𝐲𝐢𝐧𝐠 “𝐞𝐪𝐮𝐢𝐭𝐲” 𝐨𝐧 𝐚 𝐩𝐫𝐞-𝐬𝐞𝐥𝐥𝐢𝐧𝐠 𝐮𝐧𝐢𝐭/𝐡𝐨𝐮𝐬𝐞-𝐚𝐧𝐝-𝐥𝐨𝐭)

Developer must repair/restore and deliver per approved plans and within PD 957 timelines. If they fail or abandon, you can demand delivery, suspend payments, or cancel and seek refund, invoking PD 957 (and, where applicable, Maceda Law). Courts and DHSUD have backed buyer remedies in non-delivery/delay cases.

𝐁) 𝐏𝐨𝐬𝐭-𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫 (𝐲𝐨𝐮 𝐚𝐥𝐫𝐞𝐚𝐝𝐲 𝐚𝐜𝐜𝐞𝐩𝐭𝐞𝐝 𝐭𝐡𝐞 𝐮𝐧𝐢𝐭 𝐚𝐧𝐝 𝐚𝐫𝐞 𝐚𝐦𝐨𝐫𝐭𝐢𝐳𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐚 𝐛𝐚𝐧𝐤 𝐨𝐫 𝐢𝐧-𝐡𝐨𝐮𝐬𝐞)

You remain obliged to pay the loan. Claim on your property insurance—ensure it covers Acts of Nature (typhoon/flood). MRI (mortgage redemption insurance) pays the loan only upon the borrower’s death, not property damage.

𝐂) 𝐂𝐨𝐧𝐭𝐫𝐚𝐜𝐭 𝐬𝐚𝐲𝐬 “𝐨𝐰𝐧𝐞𝐫𝐬𝐡𝐢𝐩 𝐚𝐟𝐭𝐞𝐫 𝐟𝐮𝐥𝐥 𝐩𝐚𝐲𝐦𝐞𝐧𝐭,” 𝐛𝐮𝐭 𝐲𝐨𝐮 𝐚𝐥𝐫𝐞𝐚𝐝𝐲 𝐡𝐚𝐯𝐞 𝐩𝐨𝐬𝐬𝐞𝐬𝐬𝐢𝐨𝐧 (𝐦𝐨𝐯𝐞𝐝 𝐢𝐧)

Many CTS reserve title to the developer (Art. 1478) but give possession; risk allocation may be stated in the CTS. If silent, courts look at delivery/possession and stipulations. Practically, once in possession, insurers and lenders treat you as the one to insure and claim for property damage. Check your CTS and policy endorsements.

𝟒) 𝐐𝐮𝐢𝐜𝐤 𝐚𝐜𝐭𝐢𝐨𝐧 𝐩𝐥𝐚𝐧 𝐚𝐟𝐭𝐞𝐫 𝐚 𝐭𝐲𝐩𝐡𝐨𝐨𝐧 𝐥𝐨𝐬𝐬

𝟏) 𝐏𝐮𝐥𝐥 𝐨𝐮𝐭 𝐲𝐨𝐮𝐫 𝐂𝐓𝐒/𝐃𝐞𝐞𝐝 𝐨𝐟 𝐀𝐛𝐬𝐨𝐥𝐮𝐭𝐞 𝐒𝐚𝐥𝐞 & 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐩𝐨𝐥𝐢𝐜𝐲. Check turnover date, delivery acceptance, and whether Acts of Nature (typhoon/flood) riders are included.

𝟐) 𝐈𝐟 𝐩𝐫𝐞-𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫: 𝐏𝐮𝐭 𝐭𝐡𝐞 𝐝𝐞𝐯𝐞𝐥𝐨𝐩𝐞𝐫 𝐨𝐧 𝐰𝐫𝐢𝐭𝐭𝐞𝐧 𝐧𝐨𝐭𝐢𝐜𝐞 𝐭𝐨 𝐫𝐞𝐬𝐭𝐨𝐫𝐞 𝐚𝐧𝐝 𝐝𝐞𝐥𝐢𝐯𝐞𝐫 𝐩𝐞𝐫 𝐏𝐃 𝟗𝟓𝟕 𝐒𝐞𝐜. 𝟐𝟎; if timelines slip, demand remedies (specific performance, or cancellation/refund).

Lawphil

𝟑) 𝐈𝐟 𝐩𝐨𝐬𝐭-𝐭𝐮𝐫𝐧𝐨𝐯𝐞𝐫: 𝐅𝐢𝐥𝐞 𝐚𝐧 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐜𝐥𝐚𝐢𝐦 𝐢𝐦𝐦𝐞𝐝𝐢𝐚𝐭𝐞𝐥𝐲; keep paying the loan while the claim is processed. Insurable interest exists, so you can claim for your loss.

Insurance Commission

𝟒) 𝐈𝐟 𝐜𝐨𝐧𝐭𝐢𝐧𝐮𝐢𝐧𝐠 𝐢𝐬 𝐢𝐦𝐩𝐨𝐬𝐬𝐢𝐛𝐥𝐞: Explore Maceda Law rights (installment refunds/grace) plus PD 957 non-delivery remedies (if applicable).

𝐅𝐨𝐫 𝐭𝐡𝐞 𝐛𝐞𝐬𝐭 𝐩𝐫𝐨𝐩𝐞𝐫𝐭𝐢𝐞𝐬 𝐭𝐡𝐚𝐭 𝐲𝐨𝐮 𝐜𝐚𝐧 𝐢𝐧𝐯𝐞𝐬𝐭 𝐢𝐧 𝐲𝐨𝐮𝐫 𝐚𝐫𝐞𝐚, 𝐦𝐞𝐬𝐬𝐚𝐠𝐞 𝐦𝐞 𝐧𝐨𝐰:

Jan Erwin Ferrer, REB | Sienna May Pepito, REB

at m.me/smartpinoyhomeowners or via Viber/Whatsapp: 09165995537 or 09277255665

#FilipinoHomes

#RealEstateTips #BrokerWawin #TyphoonTino